Kryzys naftowy

Kryzys naftowy, określany też mianem kryzysu paliwowego, energetycznego lub szoku naftowego – kryzys gospodarczy w historii gospodarki, który rozpoczął się w roku 1973 i objął wszystkie kraje wysoko uprzemysłowione i uzależnione od ropy naftowej i wszystkie dziedziny gospodarki światowej.

Historia

Kryzys został spowodowany przez gwałtowny wzrost cen ropy naftowej na rynkach światowych, wynikający z embarga (sankcji) państw zrzeszonych w OAPEC zastosowanych wobec Stanów Zjednoczonych po wybuchu wojny izraelsko-arabskiej w październiku 1973 roku.

W latach poprzedzających wojnę arabsko-izraelską, która wybuchła w święto Jom Kipur w październiku 1973 roku, produkcja ropy naftowej ledwo pokrywała zapotrzebowanie. Dodatkowo niezwykle chłodna zima 1969/70 spowodowała wyczerpanie się lokalnych zapasów ropy naftowej i gazu ziemnego. Ta niepewna sytuacja osiągnęła stadium kryzysu, gdy Arabowie odcięli dostawy ropy naftowej i cena baryłki skoczyła o 600 procent do 35 USD.

17 października 1973 roku, w czasie trwania wojny Jom Kipur, arabscy członkowie OPEC zadecydowali wstrzymać handel ropą naftową z krajami popierającymi Izrael w wojnie z Egiptem – tzn. USA i krajami Europy Zachodniej. Jednocześnie uzgodniono nowy mechanizm ustalania cen za ropę naftową w celu uzyskania większego zysku. Zmiany uderzyły w kraje uzależnione od dostaw ropy arabskiej - USA, Japonię oraz państwa Europy Zachodniej i jednocześnie zakończyły okres beztroskiej konsumpcji kupowanego za grosze strategicznego surowca jakim jest ropa naftowa.

Nagły skok cen paliw ze względu na gwałtowne obniżenie wydobycia i eksportu do krajów rozwiniętych przyczynił się do pogłębienia kryzysu. Cena baryłki osiągnęła rekordowy wówczas pułap. W 1970 wynosiła ok. 2 USD za baryłkę.

Szok wywołany nagłym wzrostem cen skłonił rządzących w wielu krajach do daleko idących zmian w polityce energetycznej[1].

Następne kryzysy

W latach 1979–1982 miał miejsce drugi kryzys naftowy. Był on skutkiem rewolucji irańskiej. Cena ropy wzrosła wówczas do 30 USD za baryłkę w 1980 roku. W późniejszych latach zależność krajów zachodu od dostaw ropy z OPEC zaczęła maleć, głównie dzięki rozpoczęciu eksploatacji bogatych złóż z dna Morza Północnego i na Alasce.

OPEC nie był w stanie już narzucać światowych cen ropy. Pierwszy kryzys naftowy ukazał uzależnienie Zachodu od ropy oraz słabość gospodarczą państw wysoko rozwiniętych związaną z brakami paliwowo-energetycznymi. Skutkiem podniesienia cen ropy było znaczne wzbogacenie się krajów członkowskich OPEC.

Bezpośrednią konsekwencją kryzysów naftowych był kryzys światowego systemu walutowego oraz kryzys gospodarczy połączony z recesją oraz inflacją. Kryzys naftowy zdopingował do poszukiwań nowych złóż i rozpoczęcia ich eksploatacji. Doprowadził również do szukania i wykorzystania innych alternatywnych źródeł energii (np. energii jądrowej) oraz pochodzących ze źródeł niekonwencjonalnych.

W 1990 w trakcie wojny w Zatoce Perskiej cena ropy podskoczyła do 45 USD za baryłkę. W 1998-1999 ceny ropy spadły do kilkunastu dolarów za baryłkę. Od tego czasu cena ropy wzrasta. W październiku 2004 cena przekroczyła 50 dolarów za baryłkę. 29 sierpnia 2005 roku, huragan Katrina spowodował, że cena ropy osiągnęła rekordową wartość 70,85 dolara za baryłkę. W lipcu 2006 cena osiągnęła kolejne rekordowe poziomy ponad 75 USD za baryłkę, by 2 stycznia 2008 na giełdzie towarowej NYMEX w Nowym Jorku osiągnąć poziom 100 dolarów za baryłkę. Historyczne maksimum cena ropy osiągnęła 11 lipca 2008 roku, kiedy to za baryłkę surowca płacono nawet 147,16 dolara[2].

Zobacz też

Przypisy

- ↑ Ceny energii w dwa miesiące skoczyły o 300 proc. Co rządy zrobiły w 1973 roku?, SmogLab, 21 grudnia 2021 [dostęp 2021-12-21] (pol.).

- ↑ Rekordowa cena ropy, Onet.pl, 19 grudnia 2008 [dostęp 2012-07-25] [zarchiwizowane z adresu 2013-05-03] (pol.).

Linki zewnętrzne

- Bardzo pożyteczny kryzys, Newsweek.pl, 2 listopada 2003 [zarchiwizowane z adresu 2012-09-12].

- Maciej Menes, Kolejny szok naftowy, Merkuriusz Uniwersytecki, listopad 2004 [zarchiwizowane z adresu 2007-04-29].

Media użyte na tej stronie

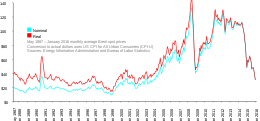

Chart showing the weekly United States spot price of crude oil from January 2003 to December 2008 in USD. Chart generated in Microsoft Excel 2007. Data from http://tonto.eia.doe.gov/dnav/pet/hist/wtotusaw.htm (United States Department of Energy)

Energy Information Awareness graph of oil prices

- OPEC begins to assert power; raises tax rate & posted prices

- OPEC begins nationalization process; raises prices in response to falling US dollar.

- Negotiations for gradual transfer of ownership of western assets in OPEC countries

- Oil embargo begins (October 19-20, 1973)

- OPEC freezes posted prices; US begins mandatory oil allocation

- Oil embargo ends (March 18, 1974)

- Saudis increase tax rates and royalties

- US crude oil entitlements program begins

- OPEC announces 15% revenue increase effective October 1, 1975

- Official Saudi Light price held constant for 1976

- Iranian oil production hits a 27-year low

- OPEC decides on 14.5% price increase for 1979

- en:Iranian Revolution; Shah deposed

- OPEC raises prices 14.5% on April 1, 1979

- US phased price decontrol begins

- OPEC raises prices 15%

- Iran takes hostages; President Carter halts imports from Iran; Iran cancels US contracts; Non-OPEC output hits 17.0 million b/d

- Saudis raise marker crude price from 19$/bbl to 26$/bbl

- en:Windfall Profits Tax enacted

- Kuwait, Iran, and Libya production cuts drop OPEC oil production to 27 million b/d

- Saudi Light raised to $28/bbl

- Saudi Light raised to $34/bbl

- First major fighting in en:Iran-Iraq War

- President Reagan abolishes remaining price and allocation controls

- Spot prices dominate official OPEC prices

- US boycotts Libyan crude; OPEC plans 18 million b/d output

- Syria cuts off Iraqi pipeline

- Libya initiates discounts; Non-OPEC output reaches 20 million b/d; OPEC output drops to 15 million b/d

- OPEC cuts prices by $5/bbl and agrees to 17.5 million b/d output

- Norway, United Kingdom, and Nigeria cut prices

- OPEC accord cuts Saudi Light price to $28/bbl

- OPEC output falls to 13.7 million b/d

- Saudis link to spot price and begin to raise output

- OPEC output reaches 18 million b/d

- Wide use of netback pricing

- Wide use of fixed prices

- Wide use of formula pricing

- OPEC/Non-OPEC meeting failure

- OPEC production accord; Fulmar/Brent production outages in the North Sea

- Exxon's Valdez tanker spills 11 million gallons of crude oil

- OPEC raises production ceiling to 19.5 million b/d

- Iraq invades Kuwait

- en:Operation Desert Storm begins; 17.3 million barrels of SPR crude oil sales is awarded

- Persian Gulf war ends

- Dissolution of Soviet Union; Last Kuwaiti oil fire is extinguished on November 6, 1991

- UN sanctions threatened against Libya

- Saudi Arabia agrees to support OPEC price increase

- OPEC production reaches 25.3 million b/d, the highest in over a decade

- Kuwait boosts production by 560,000 b/d in defiance of OPEC quota

- Nigerian oil workers' strike

- Extremely cold weather in the US and Europe

- U.S. launches cruise missile attacks into southern Iraq following an Iraqi-supported invasion of Kurdish safe haven areas in northern Iraq.

- Iraq begins exporting oil under United Nations Security Council Resolution 986.

- Prices rise as Iraq's refusal to allow United Nations weapons inspectors into "sensitive" sites raises tensions in the oil-rich Middle East.

- OPEC raises its production ceiling by 2.5 million barrels per day to 27.5 million barrels per day. This is the first increase in 4 years.

- World oil supply increases by 2.25 million barrels per day in 1997, the largest annual increase since 1988.

- Oil prices continue to plummet as increased production from Iraq coincides with no growth in Asian oil demand due to the Asian economic crisis and increases in world oil inventories following two unusually warm winters.

- OPEC pledges additional production cuts for the third time since March 1998. Total pledged cuts amount to about 4.3 million barrels per day.

- Oil prices triple between January 1999 and September 2000 due to strong world oil demand, OPEC oil production cutbacks, and other factors, including weather and low oil stock levels.

- President Clinton authorizes the release of 30 million barrels of oil from the Strategic Petroleum Reserve (SPR) over 30 days to bolster oil supplies, particularly heating oil in the Northeast.

- Oil prices fall due to weak world demand (largely as a result of economic recession in the United States) and OPEC overproduction.

- Oil prices decline sharply following the September 11, 2001 terrorist attacks on the United States, largely on increased fears of a sharper worldwide economic downturn (and therefore sharply lower oil demand). Prices then increase on oil production cuts by OPEC and non-OPEC at the beginning of 2002, plus unrest in the Middle East and the possibility of renewed conflict with Iraq.

- OPEC oil production cuts, unrest in Venezuela, and rising tension in the Middle East contribute to a significant increase in oil prices between January and June.

- A general strike in Venezuela, concern over a possible military conflict in Iraq, and cold winter weather all contribute to a sharp decline in U.S. oil inventories and cause oil prices to escalate further at the end of the year.

- Continued unrest in Venezuela and oil traders' anticipation of imminent military action in Iraq causes prices to rise in January and February, 2003.

- Military action commences in Iraq on March 19, 2003. Iraqi oil fields are not destroyed as had been feared. Prices fall.

- OPEC delegates agree to lower the cartel’s output ceiling by 1 million barrels per day, to 23.5 million barrels per day, effective April 2004.

- OPEC agrees to raise its crude oil production target by 500,000 barrels (2% of current OPEC production) by August 1—in an effort to moderate high crude oil prices.

- en:Hurricane Ivan causes lasting damage to the energy infrastructure in the Gulf of Mexico and interrupts oil and natural gas supplies to the United States. U.S. Secretary of Energy Spencer Abraham agrees to release 1.7 million barrels of oil in the form of a loan from the Strategic Petroleum Reserve.

Autor: TomTheHand, Licencja: CC BY-SA 3.0

In the process of creating Image:Oil Prices 1861 2007.svg, I realized what an incredible wealth of information is available on the Energy Information Administration's web site. The 1861–2007 graph uses yearly averages, and I couldn't think of a really satisfying way to incorporate the price jumps of the past couple of months. Anyway, I think it's alright for a graph of 150 years of history to wait until the year's end to incorporate its data.

Instead, I've created this graph, which uses all available monthly average Brent spot prices from this EIA spreadsheet and the United States Consumer Price Index for All Urban Consumers (CPI-U), seasonally adjusted, from here (This is a direct link; but there may be a better one). The monthly numbers and limited date range give good detail, and coverage up to April 2008 shows the recent price jumps. It will be about a month before I can add May 2008, because it takes a little while for the Bureau of Labor Statistics to compile the CPI for the previous month..

I have no artistic talent whatsoever, so I know the color choices aren't great, but I have no eye for this stuff. I liked the blue and orange used by the 1861–2007 but I didn't want to use the same ones over again. I just chose a pair of RGB complementary colors. I am not married to this scheme; I'm happy to discuss alternatives. It's easy for me to make changes.

I will probably make more graphs from EIA data in the future. It's getting easier to work with SVG, though I know I still have a lot to learn.Autor: TomTheHand, Licencja: CC BY-SA 3.0

I saw Image:Oil Prices 1861 2006.jpg recently and found it to be very useful. I noticed that it was in JPEG format, and saw that it was based on government sources which are available online, so I decided to recreate it in a lossless image format and update it to 2007. I've been experimenting with SVG lately, so I decided to try that instead of just saving a chart as a PNG. I found that I had to do a good bit of reverse engineering of data, and so I would like to document that here so that this graph can be more easily maintained in the future.

I found that the source quoted by the previous image, this spreadsheet from the Energy Information Administration (EIA), only provides data up to 1999 and uses 1999 dollars. It appears to provide conversions to real 1999 dollars using the United States Consumer Price Index (CPI), available from the Bureau of Labor Statistics here.

I studied the EIA web site further and noted that the author of the previous image brought the above spreadsheet up to date using the latest Brent Spot prices, available on this spreadsheet, also from the EIA. The update to 2006 dollars also appears to use the CPI.

I used the newest version of the above Brent Spot spreadsheet to get prices up to 2007, and converted to 2007 dollars using the latest CPI data.

I have thought about how to incorporate 2008 data, but haven't decided how to do it yet. The chart currently uses yearly averages; since 2008's not over yet, we don't have an average price for this year. I have to integrate it in a way that doesn't hurt the accuracy of the graph.

I have put further thought into how the EIA's 1861–1999 spreadsheet is constructed, with the intention of possibly improving it. I am not a commodities broker, nor am I an oil man, but I have a few thoughts:

- Data from 1861–1944 is available on this page of annual average US domestic crude oil first purchase prices from 1859–2007. The chart leaves off 1859–1860 data. I am not sure why, but I imagine it's because it's disproportionately expensive: $16.00 in 1859 and $9.59 1860, both in the currency of the day, ridiculously expensive in today's money. 1859 was the year oil drilling began in the United States, in Titusville, Pennsylvania, and so I imagine it took a couple of years for prices to get down to realistic levels. Prices from the first couple of years of production are probably meaningless.

- Data from 1945–1985 is said to be the price for "Arabian Light posted at Ras Tanura". I don't see anywhere else on the EIA web site where that data is found.

- Data from 1986 and up is said to be the yearly average Brent Spot. Brent Spot prices are found elsewhere on the EIA web site, but the earliest price (from this spreadsheet) is from May 20, 1987. I am not sure why they don't have prices going back to 1986.

- I think the spreadsheet converts to 1999 dollars using the United States Consumer Price Index for 1913 and up. When I convert to 1999 dollars using the CPI myself, I get numbers extremely close to the spreadsheet. It's close enough that I think either some decimal places got dropped somewhere or some earlier CPIs might have been reevaluated in the years since 1999.

However, the CPI is not available from the BLS for years before 1912. I'm not sure where the spreadsheet got its 1861–1912 conversions. In 1975 the United States Census Bureau published Historical Statistics of the United States, Colonial Times to 1970, available here. It includes their best guesses at CPIs starting in 1800, but when I tried to use them my numbers were way off. Yes, I took into account that the book sets CPI=100 at 1967. They must have gotten their data from someplace else. Another possibility is the Historical Statistics of the United States Millenial Edition, here. Being a good 30 years newer, it may have drastically different data based on more accurate research. I would have to pay for access, though.

I am not a big fan of how the graph is a composite of three different sources. It sort of seems like an apples and oranges comparison to me. The 1861–1944 data is domestic crude oil first purchase price. The EIA defines "first purchase" this way:

- An equity (not custody) transaction involving an arms-length transfer of ownership of crude oil associated with the physical removal of the crude oil from a property (lease) for the first time. A first purchase normally occurs at the time and place of ownership transfer where the crude oil volume sold is measured and recorded on a run ticket or other similar physical evidence of purchase. The reported cost is the actual amount paid by the purchaser, allowing for any adjustments (deductions or premiums) passed on to the producer or royalty owner.

The data from 1945–1985 is, as far as I understand, the price you would have paid for a barrel of light crude if you had dropped anchor at Ras Tanura and said "Load it up!". The price from 1986–present is the price you would have paid if you had gone into the International Petroleum Exchange in London flapping your arms around and shouting (or, starting in 2005, put a message to IntercontinentalExchange into a series of tubes).

These all seems subtly different to me. I think it would be better if the entire chart relied on the same source. Oil was not extracted in large quantities in the Middle East until the mid-20th century, and was first drilled in the North Sea in the 1970s, but the EIA has US domestic oil prices from 1859 all the way to today. It has month-by-month prices from 1974. Because the prices are for oil right at the field, they are lower than the market prices we're used to hearing, but they are still real prices and are from a consistent source. I am considering making a version of this graph that uses US domestic first purchase prices exclusively, and uses monthly data from 1974 onward so that we can go all the way to last month instead of waiting for the yearly average.

I made a graph that shows monthly Brent spot prices, which is available here. It provides a detailed, recent history. I plan to make some more graphs in the future.